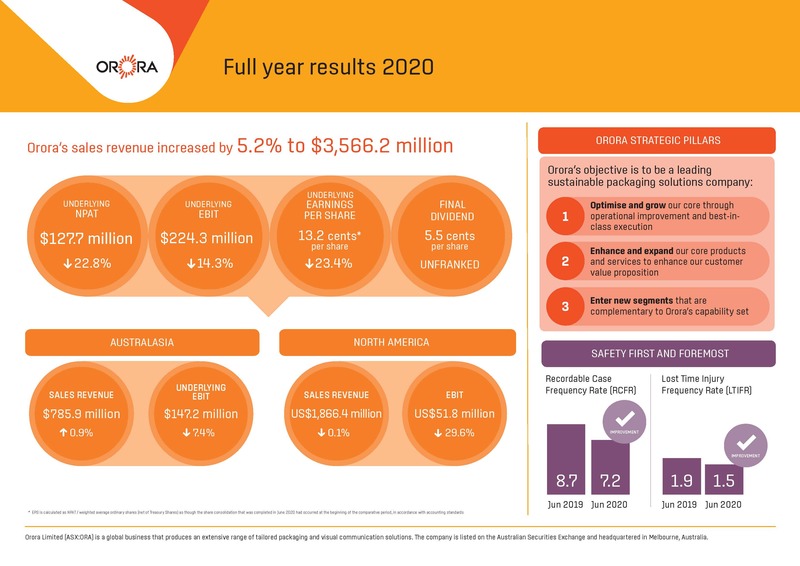

Full Year Financial Results 2020

Orora Limited (ASX: ORA) has announced financial results for the full year ended 30 June 2020. As it responded to the impacts of COVID-19 during the second half, Orora completed the sale of its Australasian Fibre business, finalised the review of its strategy, reduced debt and returned $600 million to shareholders.

Commenting on Orora’s FY20 result, Managing Director and CEO, Brian Lowe, said: “As a leading manufacturing and packaging solutions company, Orora adjusted, adapted and targeted its operations to meet the challenges presented by COVID-19 while keeping team members safe and meeting our commitments as an essential services provider.

“Orora maintained its strong focus on investment in the Australasian Beverage business during the period with the successful rebuild of the G2 furnace and capacity expansion of the Gawler Glass site, which forms part of a ~$200.0 million investment in this world class Glass facility over the last five years. The business also introduced innovations related to digital printing of Cans and embossing of Closures during the period.

“While the Australasian Beverage business saw solid growth in Cans volumes and was largely able to mitigate the impact of COVID-19, there was some unfavourable product mix across both Glass (imported product) and Cans and lower Glass (wine exports) volumes, which combined with the adverse earnings impact from the G2 rebuild, resulted in lower FY20 earnings.

“The trading conditions in North America were already tough and the emergence of COVID-19 saw both Orora Packaging Solutions (OPS) and Orora Visual (OV) results being further adversely impacted. As a result, earnings were down on the prior year. Despite this disruption, OPS continued its gross margin percentage improvement trajectory and the Pollock integration delivered revenue synergies in the Health & Safety segment during the period.

“Both North American businesses expanded their improvement programs during the second half, with further cost reduction initiatives including furlough, permanent reductions in headcount and OV consolidating its operating footprint in California which contributed to a recent stabilisation of earnings.

“Despite the near-term negative impact of COVID-19, the overall Orora business retains its strong balance sheet, which combined with the strong cash generation capability of its businesses, provides capacity and flexibility to return value to shareholders via the buyback announced today and to preserve optionality for future growth investment opportunities,” Mr Lowe said.

Capital return - Orora has today announced a further return to shareholders via an on-market buy-back of up to 10 percent of issued share capital (~96.5 million shares), at an expected cost of ~$230.0 million*, to commence September 2020. This follows the $600.0 million capital return that was completed in June 2020.

Review of strategy – The review of strategy was completed during the second half and focused on:

- critically assessing the markets in which Orora operates and trends that will influence future performance;

- confirming Orora’s core competencies and competitive advantage;

- clarifying areas of opportunity and identifying actions to address challenges within the existing portfolio; and

- innovation to identify opportunities for Orora to improve productivity and expand its range of products and services over time.

Orora has since established a set of strategic pillars that support its objective to become a leading sustainable packaging solutions company.

These include:

- Optimise and grow through operational improvement and best-in-class execution.

- Enhance and expand core products and services to enhance Orora’s customer value proposition.

- Enter new segments that are complementary to Orora’s capability set.

Orora’s strategy is expected to continue to generate strong cash flows from the core business operations. Deployment of this cash flow will be a combination of investments in the core businesses, distributions to shareholders (ongoing dividend and/or capital management), as well as strategic acquisitions that enhance Orora’s product and service offering.

More information is available under ASX releases.

* Based on the closing share price of $2.39 on 19 August 2020