Orora is well-positioned for further growth through ongoing enhancements in the core business, increasing the focus on sustainability and innovation across the Company’s portfolio, and continuing to invest in initiatives that generate additional opportunity and value for customers and shareholders.

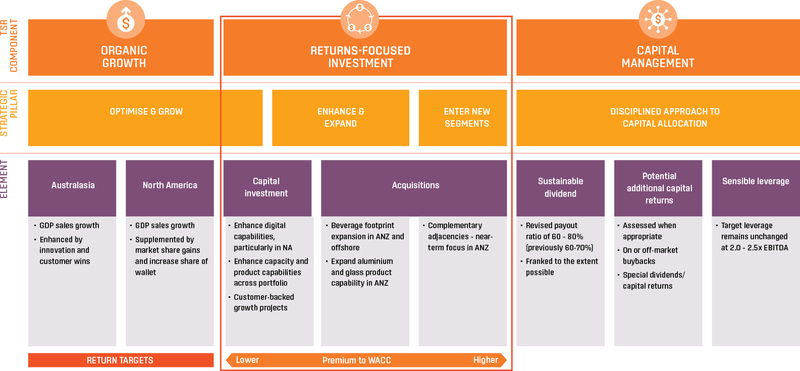

Orora’s growth strategy has three core strategic pillars, namely Optimise to Grow, Enhance & Expand and Enter New Segments, to take the Company forward. These pillars provide the basis for every aspect of strategic activity within the business, enabling Orora to capitalise on growth opportunities as they emerge. Any strategic initiatives need to be governed by continued discipline regarding the deployment of Orora’s capital.

In executing on the Company’s strategy, Orora is striving to generate top quartile TSR performance for its shareholders. The key elements which contribute to Orora’s TSR performance are outlined in the Company’s revised shareholder value blueprint below. This includes being disciplined in applying a return-focused, risk-weighted investment (for both capital projects and acquisitions) approach across each of Orora’s three strategic pillars.

As the diagram shows, Orora will target a return that represents an appropriate premium to its weighted average cost of capital (WACC) based on the risk assessed with the investment. This forms part of a rigorous approach to capital allocation, allowing the Company to appropriately make investment decisions across each pillar.

Orora’s strategy for creating shareholder value is a multi-faceted approach, comprising:

Organic growth

- In Australasia, by virtue of operating within good market structures and primarily servicing the defensive end markets of food and beverage, Orora seeks to deliver GDP based revenue growth enhanced by innovation.

- In North America, Orora expects to supplement GDP based industry revenue growth with market share gains and increased sales to existing customers via a solutions service and product offering and innovation.

Returns focused investment

- Organic growth capital – entailing investments to enhance our service and product capabilities, particularly in the digital realm, as well as customer-backed growth projects.

- Acquisitions – representing acquisitions that either expand Orora’s manufacturing footprint and/or increase its product capability, or expand Orora’s capabilities into complementary adjacent capabilities and/or markets.

Disciplined approach to capital allocation

- Sustainable dividend – Orora’s seeks to provide shareholders with a steady income stream through an indicated dividend payout ratio of 60%-80% of net profit after tax. Dividends will be franked to the extent possible.

- Potential additional capital returns – while the company is focused on deploying capital to further the company’s strategy and grow shareholder value, Orora is also committed to returning excess capital back to shareholders when circumstances dictate and there is no immediate need for that capital.

- Sensible leverage – Orora is committed to maintaining appropriate leverage on the balance sheet and will maintain its target leverage of 2.0 – 2.5 times EBITDA. This provides the Company with sufficient flexibility to pursue growth opportunities as/when they arise.